South Korea’s decision to revert the 2026 medical school enrollment quota to 3,058 students—marking a retreat from the 2024 expansion to 5,058—has reshaped the nation’s healthcare landscape. While the rollback aims to stabilize education amid prolonged student protests, it also exposes critical vulnerabilities in clinical training capacity and workforce planning. For investors, this realignment presents opportunities in healthcare real estate and medical training facilities, particularly for entities positioned to address looming specialist shortages and the „tripling effect“ risks.

The Quota Rollback: A Temporary Fix, Permanent Challenges

The government’s reversal of the 2024 quota increase was driven by student-led disruptions that crippled clinical training and patient care. With classroom attendance averaging just 25.9% across medical schools, the rollback prioritizes educational continuity over immediate workforce expansion. However, this creates a paradox: while training capacity is stabilized, the underlying shortage of specialists (e.g., in emergency medicine, pediatrics, and rural care) persists.

The “tripling effect”—a term describing overlapping cohorts of students on academic leave—adds urgency. Hospitals and training facilities face strained resources as three generations of medical students compete for limited clinical slots. This strain creates a structural demand for expanded infrastructure, particularly in regions with acute physician shortages.

Healthcare Real Estate: Scalability is Key

The quota rollback underscores the need for flexible, scalable healthcare infrastructure to accommodate fluctuating student numbers and training requirements. Investors should prioritize entities with:

1. Proximity to academic medical centers: Hospitals and clinics near universities (e.g., Seoul National University Hospital, Asan Medical Center) benefit from steady demand for clinical training.

2. Modular designs: Facilities that can expand or repurpose space (e.g., convertible classrooms, telehealth hubs) will mitigate risks from enrollment shifts.

3. Public-private partnerships: Companies collaborating with medical schools or the government (e.g., Samsung C&T (000150.KS), which partners with Samsung Medical Center) are well-positioned to secure long-term leases or development projects.

Medical Training Institutions: The Pipeline to Stability

The rollback’s emphasis on educational normalization creates opportunities for institutions that can bridge gaps in clinical training:

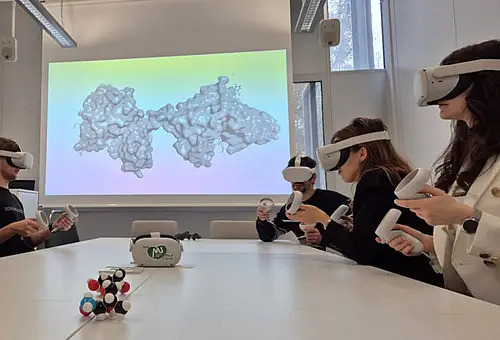

– Simulation centers: Virtual reality (VR) and AI-driven training facilities (e.g., Seoul National University’s AI-driven surgical simulators) reduce reliance on scarce clinical sites.

– Regional training hubs: Rural areas face severe physician shortages, making facilities like Jeju Island’s Jeju National University Hospital critical for expanding access.

– Corporate-academia partnerships: Firms like LG Life Science (004660.KS), which partners with medical schools for drug development training, may see demand for specialized labs and facilities.

Risks and Considerations

While the sector offers growth potential, investors must navigate:

1. Political volatility: South Korea’s healthcare policies are tied to election cycles. Presidential candidates like Ahn Cheol-soo and Hong Joon-pyo advocate divergent approaches to workforce expansion.

2. Labor shortages: Even with stable training capacity, hospitals may struggle to retain staff amid low pay and high malpractice risks.

3. Technological disruption: Telemedicine and AI diagnostics could reduce demand for certain facilities but increase need for high-tech training spaces.

Investment Recommendations

- Healthcare REITs: Focus on Korean Hospital REIT or GS REIT, which hold stakes in hospitals near top-tier medical schools. These entities benefit from steady occupancy and government-backed demand.

- Training infrastructure developers: Companies like Daewoo E&C (047040.KS), involved in constructing smart hospitals and VR training centers, may see accelerated growth.

- Specialty hospitals: Invest in facilities targeting underserved specialties (e.g., Severance Hospital’s cardiology and oncology units) to capitalize on workforce imbalances.

Conclusion

South Korea’s medical education reforms highlight a sector in flux: a temporary quota rollback buys time to address systemic flaws, but the path to workforce stability hinges on scalable infrastructure and innovative training models. Investors who align with entities offering flexibility, proximity to academic partners, and specialization in high-demand fields stand to benefit as the healthcare system realigns.

The next phase will test whether real estate and training institutions can turn policy uncertainty into enduring growth—and investors must be ready to act.

Quelle: